- VC Journal

- Posts

- Recepta

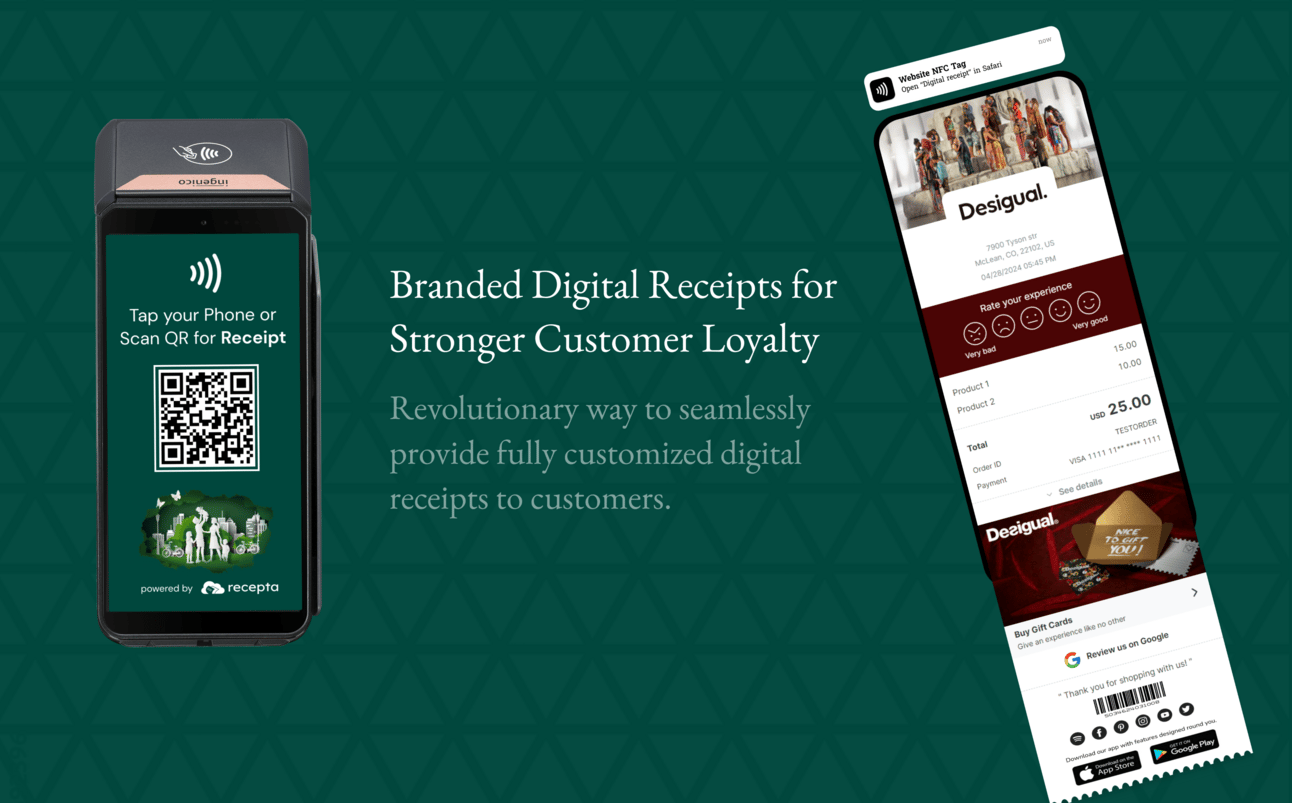

Recepta

a rising fintech led by Rauf Heydarli, turning paper receipts into powerful digital insights

In this newly launched VC Journal newsletter series spotlighting high-achieving startups from Azerbaijan and the surrounding region, our first feature is Recepta. Founded by former EY Azerbaijan and Amazon/Lyft finance professional, Rauf Heydarli, Recepta transforms traditional paper receipts into rich digital insights through partnerships with prominent POS platforms. Rauf’s journey shows how a straightforward concept, perseverance, and market-focused thinking can drive a young company onto the international stage—reinforcing Azerbaijan’s status as a birthplace for successful startups.

Hello! Who are you, and what business did you start?

I’m Rauf Heydarli, co-founder of Recepta—a digital receipts solution that reimagines those flimsy, easy-to-misplace paper slips as powerful data insights. We kicked off in 2022 and call Fairfax, Virginia, home. Our aim? To help businesses reduce paper consumption, deepen engagement with their customers, and, ultimately, encourage repeat sales. In other words, we’re taking a routine transaction and turning it into a rich, two-way value exchange for retailers and shoppers alike.

Our team is small—just 10 of us—but we’ve developed robust automation to keep things lean and still grow on a larger scale. If you’ve ever felt frustrated by piling up paper receipts in your wallet, Recepta wants to make that frustration a thing of the past.

What’s your backstory, and how did you come up with the idea?

My work history is pretty varied: I started in auditing at EY, spent time at Amazon and Hitachi managing finance and startup acquisitions, and then moved into corporate finance at Lyft. This gave me direct exposure to how companies expand and the inefficiencies they often deal with—particularly paper-based issues.

The true lightbulb moment struck during my time at Amazon. My role involved reviewing lots of expense reports for our engineering teams, and I kept seeing massive CVS receipts. It seemed wasteful, and beyond that, there was no follow-up interaction between businesses and customers once the receipts were handed over. I realized there was a significant opportunity: transform outdated paper receipts into a modern, data-driven tool.

Before Recepta, I tried my hand at various ventures—like importing wine from Azerbaijan and Georgia to the U.S.—but the glaring gap in receipts and lost customer connections persuaded me there was substantial potential for a digital approach.

Take us through the process of launching the business.

In the beginning, we planned to directly approach gyms, local shops, and other merchants to encourage them to ditch paper for digital receipts. Conceptually, it made sense, but bringing merchants on board meant shifting their mindset from paper to digital while also dealing with a wide range of POS (Point-of-Sale) systems.

Initially, we reached out to individual merchants. Eventually, though, we realized a far more effective approach: form alliances with POS providers themselves. By integrating with systems like Clover, Ingenico, PAX, and Oracle, we could instantly access a broad network of retailers who could switch on Recepta in a snap. This pivot significantly sped up our progress.

Ensuring seamless compatibility across different POS systems was (and still is) a big undertaking—think coding, debugging, and working closely with each system’s support teams. However, it was absolutely vital to make Recepta beneficial and convenient for as many merchants as possible.

How have you grown and scaled the business so far?

We’ve just begun to generate revenue, and I’m staying very cautious with expenses to keep our operations lean. We prioritize areas that directly boost value—for instance, collaborating more deeply with POS providers, enhancing the analytics merchants receive, and keeping the software easy to use.

From day one, our strategy was to keep fixed costs minimal. Automation allows us to run effectively with a small workforce, which paves the way for expansion into other markets—like the UK—without sacrificing our flexibility.

We also concentrate heavily on forging partnerships to attract clients. Collaborations with POS providers help us avoid the grueling cycle of cold-calling each store one by one. This tactic has opened discussions with well-known retailers like Nike and Adidas, moving us closer to our ambition of becoming the premier digital receipts platform.

Tell us about Sandıq, your mobile application in Azerbaijan.

Sandıq is an app we introduced specifically for the Azerbaijani market—another example of our dedication to making receipts more dynamic across different regions. After each purchase, users can scan their receipts with the app for a chance to enter weekly and monthly lotteries. This transforms ordinary receipts into a fun, potentially rewarding experience.

Here are the main features:

Receipt Scanning: Users simply scan a receipt to collect entries for various prize draws.

Expense Tracking: Sandıq centralizes scanned receipts in one place, allowing users to monitor their spending patterns.

Lotteries & Rewards: By amassing entries, users automatically join routine lotteries for appealing prizes, injecting some excitement into day-to-day shopping.

User Engagement: Short surveys and referral programs incentivize users to boost their lottery entries while fostering a sense of community.

Sandıq is available on both iOS and Android. Since its debut, it has reached over 50,000 downloads on Google Play, with users praising its simplicity—one reviewer put it succinctly as “Super və asan istifadə olunur.” We’re eager to explore how this concept could grow in other markets as well.

How has your background influenced your approach?

My time at companies like Amazon and Lyft helped me cultivate a strategy-first mindset, particularly in pinpointing and solving customer pain points. Working in roles that spanned finance, marketing, and acquisitions taught me to oversee cross-functional teams, handle M&A, and map out grand financial roadmaps. All of this experience paved the way for building and scaling a venture like Recepta—from fundraising to hiring and beyond.

Also, spotting the massive missed opportunity tied to paper receipts—a big waste of resources as well as squandered data—really fueled my drive to seek out a digital remedy.

How has running your own business changed your lifestyle compared to your corporate career?

It’s a complete 180. In a corporate setting, roles are well-defined, targets are set, and processes are established. With Recepta, each day involves juggling a variety of tasks—product management, forming partnerships, hiring, and marketing. It means more hours and more risk, but there’s a unique joy in building something from scratch.

I lean on structure to stay productive: a steady morning regimen, setting daily benchmarks, and regularly tracking progress. I also make sure to carve out personal downtime—short breaks, family time, exercise—to dodge burnout. It’s a balancing act, but I’ve learned the hard way that productivity falls apart if you’re running on empty.

What were some of the biggest lessons you’ve learned?

Validate Early: Don’t invest heavily in an idea without confirming market demand. I conversed with lots of shop owners and industry folks early on to verify that a digital receipt solution had legs.

Stay Flexible: Don’t be afraid to change direction if something isn’t working. We initially tried direct sales to merchants, then pivoted to partnerships with POS systems, which supercharged our growth.

Tap Into Mentors: I wish I had sought guidance from seasoned advisors sooner. People like Kevin Fumai (Oracle VP) and Samir Suleymanov (Former Deputy CEO – World Bank) have been incredibly helpful in avoiding pitfalls.

What are your future plans for Recepta?

Within the next five years, I see Recepta as the go-to digital receipts solution for major international brands like Nike and Adidas, integrated with all the top POS providers. Each collaboration furthers our aim to become a comprehensive platform for customer loyalty, engagement, and insight-driven data.

We’re also looking at rolling out loyalty features and advanced analytics. Our ultimate objective is to link receipts directly to Apple and Google wallets, making digital receipts a natural part of daily transactions. At the same time, we’re close to expanding into the UK, thanks to productive conversations with POS providers there.

As for staffing, we plan to remain relatively small. Extensive automation in our product means we can operate efficiently without a large headcount, keeping us nimble and laser-focused on delivering a standout product.

Any advice for people looking to leave the corporate world and start their own thing?

Identify a Real Problem: Work on something that has genuine demand. Chat with potential customers, gather their feedback, and make sure you’re solving a tangible issue.

Leverage Corporate Know-How: Those experiences with budgets, scaling, and strategy can be huge assets, but be ready for an environment that’s more rapid-fire and less predictable.

Build a Support Network: Seek out mentors, peers, or advisors early. Don’t try to carry every task alone. Delegation or automation is critical so you can focus on your core objectives.

Practice Resilience: The startup path is volatile, but if you can adapt and keep pushing forward, it can also be incredibly fulfilling.

Quick Facts & Figures

Startup Name: Recepta

Founder(s): Rauf Heydarli (CEO) and a co-founder/CTO from Synctera

Year Founded: 2022

Location: Fairfax, Virginia, USA

Industry: Software (B2B SaaS)

Website: www.receptapp.com

Contact: [email protected]

What We Do: Provide digital receipts that empower businesses with actionable consumer insights, cut down on paper waste, and foster stronger customer engagement.

Initial Investment: $30k

Funding Rounds: Pre-seed (UniCapital $200k, Moonwake $50k, Techstars $100k, Hi2Global $25k)

Current Valuation: $10M

Key Partnerships: Clover, PAX, Ingenico, Oracle

Major Achievements: Deployed on Clover and Ingenico Android devices across the USA and Canada

Team Size: 10

Future Funding: Aiming to secure $3M in 2025 for sales, marketing in the U.S., and UK growth

Awards & Recognition:

EBRD Star Ventures

Teknofest 2022

Most Innovative Digital Receipts 2024

Techstars JP Morgan 2024

VISA Innovation Partner

Media Mentions:

Digital Journal

Visa Innovation Program

Hackquarters Blog